Fortiva is a famous banking institution in the United States. Provides an official web portal for credit card users. From there, Fortiva credit card users can log in and manage their Fortiva account online. Once you’ve logged in through the Fortiva app, you can manage your Fortiva payment, apply for a new loan, and more from home.

You do not have to come to the agency in person to use all of the services.

If you go through this page, you will get all the details on how to sign up for Fortiva Payments. Therefore, we recommend that you read this page carefully and review the information.

Online Registration Procedure To Get New Credit Card

If you want to apply for a credit card, go nowhere and apply online. After a few steps, you can complete an application form to apply for a Fortiva credit card. Take a look at the steps here:

- You must visit the Fortiva Credit card login page at www.myfortiva.com

- Click the “Submit Your Quote and Request Your Card” link above.

- You must enter the acceptance code in the empty field.

- You will find the code below in your email offer.

- Click the “Submit Code” button and follow the step-by-step instructions.

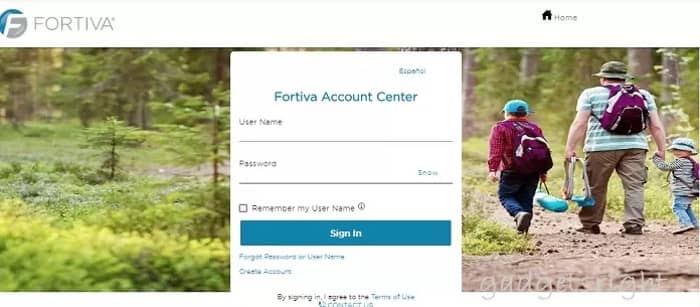

Step-By-Step SignUp Process For An Successful Login

To make payments, manage your credit card account, transfer money, use bank statements, and many other features of a Fortiva credit card, you must first register at the Fortiva Credit Card login page. Once you have logged in, you will no longer be able to use your Fortiva credit card. The steps to log into your credit card account are as follows.

- First of all, you need to visit the official Fortiva Credit Card login website by clicking this link www.myfortiva.com.

- Then you will be redirected or landed on the site and you will need to go to the right side of this page.

- Then you must enter your username and password.

- Then click Stay logged in if you want the site to remember you.

- Then click the “Register” button to complete the registration process and use the Fortiva credit card login.

Forgot Credentials? Know-How To Reset To Obtain New

If you have lost your credentials, don’t worry. You can easily access your login details or you will receive a new one. To easily obtain your credit card details from Fortiva, you must follow these simple steps.

- You need to click on this link www.myfortiva.com to go to the website and then to the login panel.

- After accessing the site, you must click on “Forgot your password?” “Click.” Click. If you have lost your password and username, you must click on “Username”.

- Then follow the instructions and fill in the required information to recover your lost Fortiva credit card details.

Here’s A Troubleshooting Guide In-case You Cant Login

- Navigate to the official Fortiva loan application page using the links below. When you click on it, your browser will automatically open a new tab for further troubleshooting, if necessary.

- Enter your login information. This is information provided by Fortiva Loan Payment Login during registration or by a Fortiva Loan Payment Login employee.

- After pressing “Enter”, a pop-up window should appear on the screen informing you that you have successfully logged into Fortiva Loan Payment Login.

- If you are unable to log into the Fortiva Loan Payments login page, you can use the guide below to begin troubleshooting or contact us for assistance.

Easy Method To Activate The Card

The Fortiva credit card can be activated in the Fortiva Account Center and the process is very simple. Once you have logged into the official Fortiva website, you will find the Activate option in the upper right corner of the page and select it. The user has two options to activate the card and must register or log in.

People who already have a Fortiva account can log in by entering their username and password and clicking on the Fortiva login option and the Fortiva card has been activated successfully.

Amazing Credit Card Features Provide By Fortiva

There are many features and benefits to using a Fortiva credit card. If you have a Fortiva credit card, you have an advantage in these circumstances. The most important features and benefits are written here for you.

- If your credit score is very low, you will need to leave a deposit to obtain a credit card. However, Fortiva offers the option of having a credit card without a deposit.

- A Fortiva credit card gives you easy access to your credit history.

- The Fortiva credit card is available to you without liability for fraud, which means that you can use a Fortiva credit card without liability for fraud. Your payment history is monitored by three major credit reporting agencies.

- You can use your Fortiva credit card account online to set up an automated payment system with your Fortiva credit card.

- If you want to review your old and new transactions, you can do so with your Fortiva credit card.

- You can also redeem your rewards and keep track of your points.

- You can set up account notifications with a Fortiva credit card.

- You can transfer your funds, download bank statements, and many other features available through a Fortiva credit card.

3 Useful Benefits Of The Card By Fortiva

Interested parties can receive the card even if its credibility is low.

- Fortiva credit cards can be used to determine a person’s creditworthiness.

- Fortiva credit cards offer $ 0 fraud liability

- Credit card security has been enhanced with the EMV chip, which reduces the risk of counterfeiting.

Eligibility Criteria To Aquire New Credit Card

- The first condition is legal residence in the United States (Mexico and Canada),

- Your age must be over 18 years old.

Once you have successfully created an account, your credit score will be displayed each time you log in. This must be done within 60 days. Equifax offers VantageScore 3.0 creditworthiness and it’s free with your account.

Why Should I Apply For A Mastercard Credit Card?

Technically, the Fortiva Mastercard cannot be ordered directly. Requests are only possible for those who have received a mailed offer and an acceptance code. But for those who have received an email and are wondering if the offer is worth responding to, the answer will be “no” in most cases.

Improving your credit score comes at a cost, as you might expect, but the Fortiva credit card is probably more expensive than most people expect. High upfront and ongoing costs (annual fee, monthly maintenance fee, and well-above-average APR) likely result in total costs that are just as high (if not higher) than what could have been paid as collateral for traditional insurance. Menu.

Fees aside, it’s not worth avoiding paying upfront to sacrifice your ability to increase your credit limit.

However, if you run out of potential card options, don’t have the cash to purchase a secure card title, or have already accepted the offer, consider Fortiva Mastercard as a temporary resource. This card is not designed as a long-term credit recovery option (due to the lack of credit enhancement opportunities) and will not grow as your credit history improves.

| Official Name | Fortiva Credit Card |

|---|---|

| Organization | Fortiva |

| Porta,l Type | Login |

| Services | Credit Card |

| Country | USA |

Payment Procedure To Pay Credit Card Bill

Paying with a Fortiva credit card involves creating an account to make other necessary payments. Find out how to keep track of your card and control all transactions. Tenerife a new account with Fortiva is another effective way to use fortiva.com as a client

- Create an account by logging into www.myfortiva.com. through any browser of your choice.

- Start the account with card information such as card number, name as it appears on a credit card, credit card security number, last 4 digits of your primary SSN.

- Click Submit to view another phase of the online registration.

- After successfully registering your Fortiva credit card, your credit offer is ready for emergencies and international transactions with additional fees.

Pay Bill By Mail

All you need to do here is send your payment to the following address:

process the payment,

TO POST. P.O. Box 790156,

Saint-Louis, MO 63179-0105.

Bill Payment Using Phone

Fortiva’s customer service phone number for payments is 1-800-245-7741.

At this point, you can make your payment in one of the three ways listed above.

However, please note that the Fortiva Credit Card, Fortiva Retail Credit, and Fortiva Personal Loan products are issued by the Bank of Missouri, St. Robert, Missouri.

Credit Card Highlights

- Credit limit of up to $ 1,000 subject to credit approval

- Get a 3% discount on gas, groceries, and utilities

- Receive 1% cashback on all other purchases

- Free access to your Equifax® VantageScore® 3.0 score

- Unsecured credit card

- Periodic review of credit lines

- Prequalification without affecting your solvency

- No deposit or program fees

Do You Know About The Fortiva App

As long as your Android or smartphone has room to download and install an app, believe me when I say it’s super straightforward.

To download the Fortiva mobile credit card app, quickly grab your cell phone, open your game or app store, and search for the Fortiva mobile app. Once you find it, it is a quick download.

Things You Should Know About The Fortiva

Fortiva is a recognized banking organization based in the United States of America. and the Fortiva credit card is one of the services that Fortiva offers. Fortiva offers several types of financing solutions, including flawed loans. Fortiva is a subsidiary of Atlanticus Holdings Corp. and belongs to the financial services sector. Fortiva was founded in 2009 and is currently based in Atlanta, Georgia. Fortiva employs about 500 people and provides services such as financial and second-view loans, as well as loans such as home furnishings, electronics, and drugs. Fortiva offers alternative credit solutions.

Frequently Asked Questions

Does the Fortiva credit card have a refund or rewards program?

No, it does not offer a rewards program.

What is the relevant APR for the Fortiva credit card?

According to the Federal Reserve Board, the average regular APR is 15% for all credit cards and 17% for cash accounts. It has regular APRs above average.

It has a variable annual percentage rate on purchases between 22.74% and 36%. The card has a variable cash balance transfer between 25.74% and 36%. It also has a variable annual cash advance percentage between 25.74% and 36%.

Are there international transaction fees for the Fortiva credit card?

The Fortiva credit card has an international transaction fee of 3%. For example, if you spend $ 2,000 on a week of vacation abroad, you will pay an overseas transaction fee of $ 60. When traveling abroad, you may want to leave this card at home and apply for a card that does not charge for transactions.

How do people rate the customer service and user experience of the Fortiva credit card?

In general, the Fortiva credit card is not recommended due to community ratings for customer service and user experience.

Fortiva Credit Card Customer Service Team

Fortiva cardholders can use Fortiva credit card login customer service.

In addition to general assistance, such as answering questions about how to use the card and issuing transaction instructions, the employees who work there can also offer other useful services: such as sending replacement credit cards. Activate accounts without leaving a deposit; Advice on other Fortiva products and more.

Email: Fortiva P.O. BOX 105555 Atlanta, Georgia (30348-5555)

Visit: www.myfortiva.com

Official Headquarters Address: 5 Concourse Parkway, Atlanta, GA (USA)

Call 800-245-7741

Endnote On The Online Portal

These users have questions about Fortiva credit card login, Fortiva billing, Fortiva payment, Fortiva payment login; You can leave a comment in the comment section below. We wait! Everyone is happy with the information above.